Vanguard Real Estate ETF: Poor Outlook For The Housing Market (NYSEARCA:VNQ)

ArLawKa AungTun

Introduction

The Vanguard Real Estate ETF (NYSEARCA:VNQ) is an exchange-traded fund (ETF) that seeks to outperform a benchmark index of world-wide actual estate corporations. Vanguard manages the fund, which is supposed to give investors with exposure to a varied portfolio of corporations that own or function commercial and residential true estate these kinds of as place of work buildings, apartments, warehouses, and other sorts of industrial and residential true estate.

The ETF has a very low expenditure ratio of .12{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}, creating it a reduced-price tag way to gain publicity to world wide real estate companies. The fund is appropriate for traders trying to get exposure to the genuine estate industry as nicely as probable money and diversification rewards.

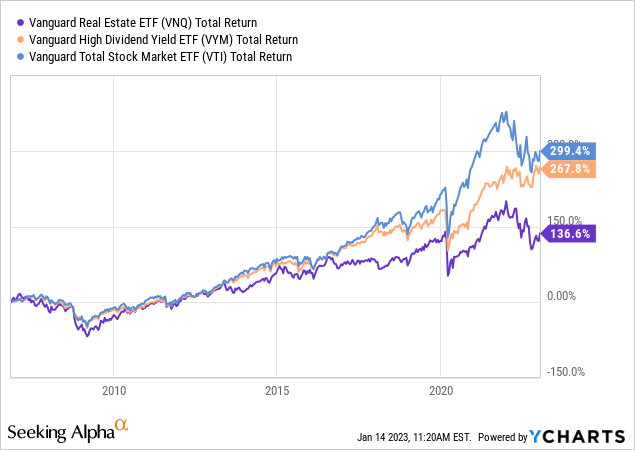

The return of the ETF was significantly decrease than that of the Vanguard superior dividend produce ETF (expenditure ratio = .06{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}) or the Vanguard full stock market ETF (expenditure ratio = .03{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}). The price ratio of the Vanguard Serious Estate ETF was substantially better than that of the other ETFs in the chart down below.

This post offers a swift overview of the present photograph of the overall housing sector in comparison to historic figures. Two perfectly-recognised house selling price ratios are at all-time highs, which could spell undesirable news for home charges and the fairness rate of the Vanguard Genuine Estate ETF as property finance loan prices rise.

Real Estate Prices Are At All-Time Significant

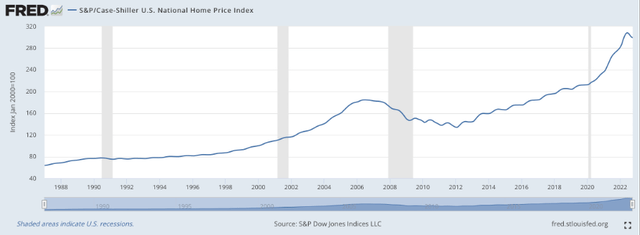

The S&P Scenario-Shiller House Price tag Index is a effectively-recognized household value index that can be employed to get perception into residence costs. The S&P Scenario-Shiller House Rate Index tracks improvements in dwelling charges in the United States. It is a composite of solitary-family members house rate indices for the 9 Census divisions in the United States. The index is computed utilizing the repeat gross sales process, which compares the gross sales costs of similar attributes around time. The index is printed regular monthly and is greatly made use of to monitor the housing industry by economists, actual estate pros, and the media. In addition, the index is applied to regulate the values of adjustable-price home loans and to forecast long run dwelling costs. It is regarded as a single of the ideal indicators of the housing market’s health and fitness.

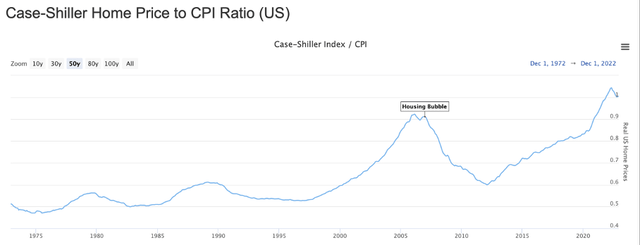

There are two common ratios that can be graphed to obtain insight into house value valuation. The dwelling selling price to CPI ratio is just one of them.

The dwelling price tag to client selling price index (CPI) ratio

The dwelling price tag to customer price index (CPI) ratio steps the connection concerning alterations in house prices and improvements in dwelling charges. It is calculated by dividing the improve in house price ranges by the improve in the Client Selling price Index (CPI). A ratio greater than 1 suggests that property costs are mounting a lot quicker than the cost of living, whereas a ratio less than one indicates that residence prices are growing slowly and gradually. The ratio can be employed to chart the evolution of housing affordability about time.

The graph underneath displays that the property selling price to CPI ratio is at an all-time high of a lot more than one. When compared to historical averages, household prices are escalating at a quicker fee than the customer value index. During the low desire fee setting at the commence of the corona disaster, property price ranges seasoned a significant increase. Individuals went on a housing buying spree for the duration of the lockdown. Simply because fascination fees have been reduced, they could borrow a whole lot of money, causing residence charges to skyrocket. The natural way, this is unsustainable in the lengthy operate, in particular if interest prices continue on to increase.

Throughout the past 50 percent-century, the ratio has increased while fascination prices have diminished drastically. That claimed, I believe a ratio amongst .6 and .8 is fair (the selection from dept of the housing crisis and right before the rally in 2020). Residence prices would require to drop when inflation rose for the ratio to return to average levels.

Scenario-Shiller Residence Price to CPI Ratio (United States) (longtermtrends.net)

The property selling price to CPI ratio is presently skewed downward, and the S&P Circumstance-Shiller House Rate Index demonstrates that property prices have fallen from latest highs. Inflationary pressures rose in 2022, which I see as a fantastic recipe for authentic household price declines.

S&P / Scenario-Shiller US Nationwide Household Value Index (FRED)

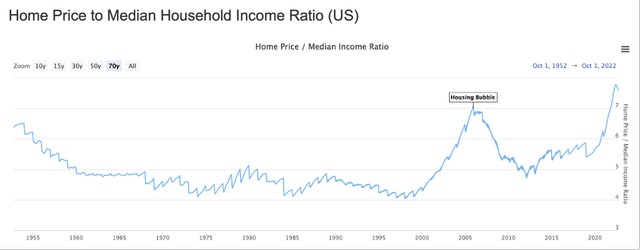

The residence selling price to median house profits ratio

The household rate to median residence cash flow ratio is the 2nd ratio to consider when valuing a house.

The property price to median residence revenue ratio actions the romance among the cost of housing and the typical household’s cash flow level. It is calculated by having the median household value and dividing it by the median domestic revenue. This ratio can be utilized to observe housing affordability about time and throughout markets. The ratio has fluctuated among 4 and 8 around the final 70 many years curiosity costs and housing offer are two dependent variables that generate up residence rates. Boom cycles can are unsuccessful, and we can see in the graph below that housing is highly-priced in comparison to historical figures. The ratio is skewed downward, implying that home rates have a tendency to tumble although median domestic profits rises.

Home Price tag to Median Family Money Ratio (United States) (longtermtrends.web)

A thousand phrases are expressed in two graphs. Equally suggest that house market is high-priced, which is due to traditionally reduced property finance loan costs and a lack of source. Institutional possession now accounts for 40{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} of all single-family rental acquisitions. If they are unable to fulfill their credit card debt obligations, they are much more probably to market a massive number of homes for a lower selling price. At 1.86{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}, the delinquency level for solitary-household residential home loans remains extremely small. I do not believe homeowners are in risk, but I imagine institutional traders will offer in the coming many years, resulting in dwelling rates to fall. They need to refinance their credit card debt at a increased interest charge and desire to provide their homes to lessen their financial debt load.

The dividend fee has not improved

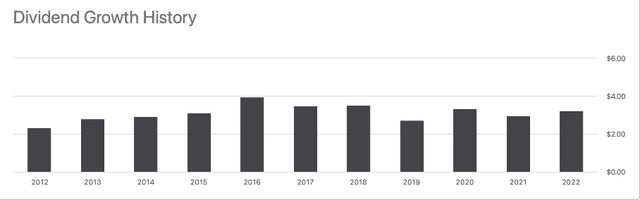

Finally, permit us talk about dividends. From 2017 to the current, the dividend level has not amplified and has fluctuated. The existing dividend rate is $3.23, representing a dividend generate of 3.66{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}.

Dividend growth background (Seeking Alpha VNQ ticker page)

Lots of other REITs with developing revenue, earnings, and FFO are available at a decrease valuation and thus a increased dividend generate. Take into consideration Crucial Homes (EPRT) with a dividend produce of 4.5{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}. Upcoming 12 months, the dividend level is expected to rise by 3{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}. The dividend produce of Vonovia (OTCPK:VONOY), a European serious estate inventory, is 6{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}. LEG Immobilien’s (OTCPK:LEGIF) dividend yield is 5.4{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}. In August 2022, I wrote about these and other German Serious Estate shares.

Serious estate values are predicted to drop, but the Vanguard True Estate ETF hasn’t seen a sizeable selling price drop however. The dividend yield is only 3.66{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}, and the dividend rate has not enhanced due to the fact 2017. Other Authentic Estate companies give a better dividend generate. When in contrast to other REITs and European Real Estate stocks, the Vanguard Serious Estate ETF is overpriced centered on the dividend yield.

Editor’s Be aware: This posting discusses a single or additional securities that do not trade on a significant U.S. exchange. Make sure you be mindful of the dangers affiliated with these stocks.