Luxury-Home Sales Sink 18{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}, the Biggest Decline Since the Start of the Pandemic

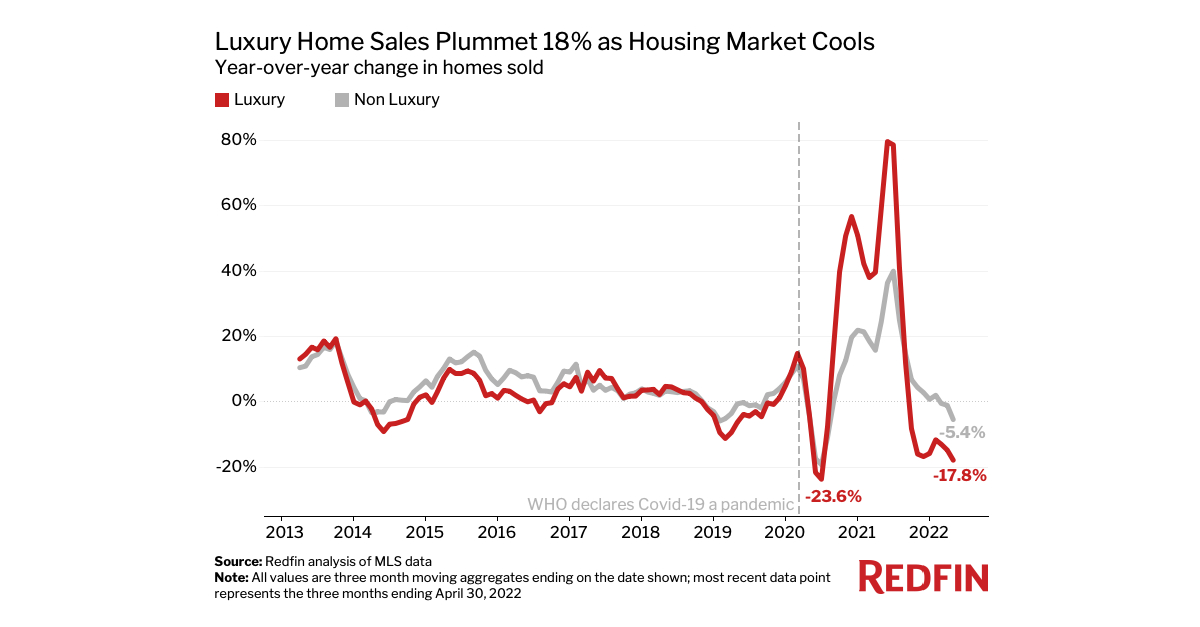

SEATTLE–(BUSINESS WIRE)–(NASDAQ: RDFN) — Sales of luxury U.S. homes fell 17.8{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} year over year during the three months ending April 30, the largest drop since the onset of the coronavirus pandemic sent shockwaves through the housing market. By comparison, sales of non luxury homes fell 5.4{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}. That’s according to an analysis of luxury real estate trends from Redfin (www.redfin.com), the technology-powered real estate brokerage. The analysis divides all U.S. residential properties into price tiers based on Redfin Estimates of homes’ market values and defines luxury homes as the most expensive 5{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} of homes in each metro area.

The luxury market is cooling as soaring interest rates, a tepid stock market, inflation and economic certainty put a damper on demand. For a luxury buyer, a higher mortgage rate can mean a monthly housing bill that’s thousands of dollars more expensive. The year-over-year cooldown is also a reflection of the market for high-end homes coming back to earth following a nearly 80{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} surge in sales a year ago.

Luxury-sales growth began to slow in the spring and summer of 2021 amid an extreme shortage of high-end properties for sale, which restricted how many homes could be sold. Although the inventory crunch has started to ease, the shortage of luxury homes on the market is still likely contributing to the drop in luxury sales.

“The pool of people qualified to purchase luxury properties is shrinking because the stock market is falling and mortgage rates are rising,” said Elena Fleck, a Redfin real estate agent in West Palm Beach, FL. “The good news for buyers is the market is becoming more balanced and competition is easing up. Of course, that doesn’t help the scores of Americans who have been priced out altogether.”

Rising interest rates have triggered a slowdown in the housing market as a whole in recent weeks. The average 30-year fixed mortgage rate was 5.23{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} during the week ending June 9, down slightly from a 2022 peak of 5.3{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} but still significantly higher than 3.11{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} at the end of last year. Mortgage rates for jumbo loans, the type most luxury borrowers use, have also been surging. The rate on a 30-year jumbo loan was 5.06{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} as of June 8, up from 3.23{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} at the end of 2021.

“I had one seller in Delray who went under contract on their home for over $2 million in March, right in the middle of an interest-rate hike,” said Fleck. “The buyers backed out because they realized their mortgage payment would rise by more than $3,000 per month with the higher interest rate. They could no longer afford the house comfortably.”

Luxury-Home Prices Are Still Surging, But Not as Quickly as a Year Ago

The median sale price of luxury homes rose 19.8{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} year over year to $1.15 million during the three months ending April 30—roughly the same growth rate as non luxury homes. While that’s still above pre-pandemic levels of less than 10{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}, it’s down from a peak of 27.5{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} in the spring of 2021.

The High-End Inventory Crunch Is Easing as Luxury Listings Rise for First Time This Year

The inventory crunch in the high-end housing market is easing as the drop in sales leaves more homes available for purchase. The supply of luxury homes for sale fell 12.4{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} year over year during the three months ending April 30. That compares with a record decline of 24.6{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} during the summer of 2021, when there was still intense demand for high-end homes. The supply of non luxury homes fell 8.4{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} during the three months ending April 30.

An increase in new luxury listings is one reason overall luxury supply isn’t falling as sharply as it was last year. New listings of luxury homes rose 1.1{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} year over year during the three months ending April 30, the first increase since summer 2021.

Metro-Level Highlights: Luxury Homes Sales Fall Sharply on Long Island, Increase in New York City

- Home sales: Luxury home sales fell in all but one of the top 50 metros. The biggest decline was in Nassau County, NY (-45.3{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} YoY), followed by Oakland, CA (-35.1{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), Dallas (-33.8{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), Austin, TX (-33{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}) and West Palm Beach, FL (-32.8{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}). The only increase was in New York (+30{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}).

- Prices: The median sale price of luxury homes rose in all of the top 50 metros. It was up the most in Tampa, FL (+33{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} YoY), followed by San Diego (+31.4{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), Jacksonville, FL (+31.2{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), Nashville (+30.3{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}) and Fort Worth, TX (+29.4{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}).

- New listings: New listings of luxury homes increased in 16 of the top 50 metros. The biggest gain was in Warren, MI (+32.2{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} YoY), followed by New York (+31.1{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), San Antonio (+22.8{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), Detroit (+22.3{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}) and Nashville (+18.4{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}). The biggest declines were in Oakland (-28.4{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), Los Angeles (-27.6{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), Anaheim, CA (-25.2{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), San Francisco (-24.9{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}) and San Jose, CA (-23.6{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}).

- Supply: Active listings of luxury homes dropped in all but five of the top 50 metros. The biggest declines were in Anaheim (-38.7{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} YoY), Los Angeles (-36.1{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), Miami (-33.7{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), San Jose (-32{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}) and Oakland (-31.3{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}). The metros that saw increases were San Antonio (+22.4{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), Warren (+15.1{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), Columbus, OH (+7.3{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), Detroit (+4.7{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}) and Nashville (+0.1{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}).

The full report, complete with charts and data for the 50 largest metro areas, is available at https://www.redfin.com/news/luxury-home-sales-april-2022.

About Redfin

Redfin (www.redfin.com) is a technology-powered real estate company. We help people find a place to live with brokerage, instant home-buying (iBuying), rentals, lending, title insurance, and renovations services. We sell homes for more money and charge half the fee. We also run the country’s #1 real-estate brokerage site. Our home-buying customers see homes first with on-demand tours, and our lending and title services help them close quickly. Customers selling a home can take an instant cash offer from Redfin or have our renovations crew fix up their home to sell for top dollar. Our rentals business empowers millions nationwide to find apartments and houses for rent. Since launching in 2006, we’ve saved customers more than $1 billion in commissions. We serve more than 100 markets across the U.S. and Canada and employ over 6,000 people.

For more information or to contact a local Redfin real estate agent, visit www.redfin.com. To learn about housing market trends and download data, visit the Redfin Data Center. To be added to Redfin’s press release distribution list, email [email protected]. To view Redfin’s press center, click here.

/cloudfront-us-east-1.images.arcpublishing.com/dmn/O2J5Z4GLWVJNII37X5C2376ZPM.jpg)