U.S. Home Prices Slowed from Record Appreciation in First Quarter, Radian Home Price Index Reveals

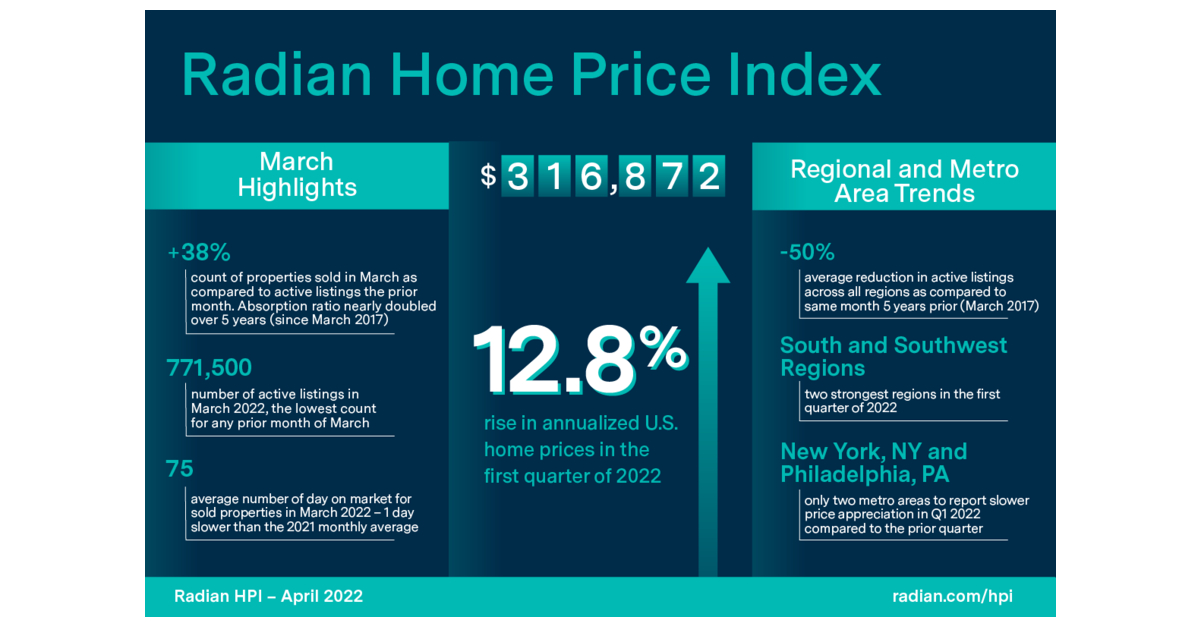

WAYNE, Pa.–(Enterprise WIRE)–Property prices throughout the United States rose in the to start with 3 months of the year at an annualized price of 12.8 p.c, according to Radian House Selling price Index (HPI) data introduced today by Purple Bell Serious Estate, LLC, a Radian Group Inc. firm (NYSE: RDN). The firm believes the Radian HPI is the most extensive and timely evaluate of U.S. housing sector rates and problems.

The Radian HPI also rose 15.3 {73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} year-around-calendar year (March 2020 to March 2021), which was marginally larger than the year-more than-calendar year increase of 15.2 p.c recorded past month. The Radian HPI is calculated primarily based on the believed values of a lot more than 70 million distinctive addresses each individual thirty day period, masking all one-household residence sorts and geographies.

“The initially quarter observed a pullback from the file speed of household price tag appreciation witnessed in modern quarters. The current evaluate is even now drastically larger than prior yrs, but new headwinds to affordability and offer are negatively impacting both equally the ability and willingness to invest in a household. And, though the refinance industry is much more sensitive to property finance loan fee actions, there is minimal problem that larger home finance loan payments have began to affect homebuyer self-assurance as perfectly,” pointed out Steve Gaenzler, SVP of Solutions, Knowledge and Analytics. “In a lot of marketplaces, profits transactions are nonetheless closing speedily and listing volumes continue to be minimal, but a moderation of house value appreciation costs relative to 2021 is a genuine risk,” included Gaenzler.

Countrywide Data AND Developments

- Median residence rate in the U.S. rose to $316,872 in March

- Dwelling charges rose an annualized 12.7 percent through March

After slowing in appreciation costs in every of the prior five months, home selling price appreciation increased in March at a a lot quicker charge of 12.7 p.c on an annualized basis, an acceleration of residence price appreciation above the 11.8 percent annualized boost in the prior thirty day period. Nationally, the median believed rate for one-spouse and children and condominium residences rose to $316,872 in March from the $274,978 recorded a 12 months earlier (March 2021), marking a approximately $42,000 maximize in the median residence worth nationally in excess of the very last twelve months. In point, all through the initially quarter of 2022, residence costs rose an annualized 12.8 per cent. This represented a large decline from the 17. {73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} annualized raise throughout the fourth-quarter 2021, but remained considerably above the 9.4 per cent annualized gain in the initial quarter of 2021.

Supply stays very constrained for both distressed and non-distressed houses. Whilst most federal and point out foreclosure moratoriums have been lifted, the number of distressed residence listings stays close to historic lows. This month the count of distressed (REO, short sale) listings represented just 4.3 per cent of all listings, just a little above the all-time low of 4. per cent recorded a couple of months earlier. Strong home-owner fairness progress more than the final couple of decades has pushed down bank loan-to-worth ratios across the place, giving a non-distressed sale alternative even to those householders that can no longer afford to pay for their current home.

In standard, the volume of energetic listings of properties for sale proceeds to remain at historically minimal stages In March, the U.S. experienced just around 770,000 lively for-sale listings, a little bit larger than the all-time minimal stock reported two months in the past. Also, very last thirty day period reported just in excess of 285,000 shut sales transactions, a variety far underneath the 303,000 claimed in March 2021. Having said that, compared to the absorption of listings because of to gross sales (the Profits-to-Listing ratio), even at the reduced gross sales counts, this represents a greater share of listings. 5 yrs in the past, the selection of profits represented about 20 percent of total prior month lively listings. Previous thirty day period, the revenue-to-listing ratio rose to 38 percent, suggesting that relative to the depressed volume of listings, the industry is continue to aggressive and buyers’ options continue being limited.

REGIONAL Details AND Developments

- Initial quarter 2021 success are good for all Regions

- Provide is 50+{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} reduce on normal, than 5 12 months in the past, throughout all regions

Previous thirty day period, three regions – the South, Southwest and West – noted speedier appreciation rates than the prior month. In the first a few months of 2021, all 6 regional indices recorded constructive home rate appreciation prices. As opposed to the fourth quarter of 2021, all but 1 location recorded slower residence price tag appreciation. The South region actually posted a faster annualized amount of appreciation in the initially quarter of this yr than the last quarter of 2021. Powerful sales proceed to help these constructive appreciation rates. Nationally, the first quarter of 2022 recorded just below 730,000 whole closed gross sales, a little underneath the 750,000 file set in the first quarter of 2021, and still was the next-strongest Q1 on file.

Probably impacted by seasonal declines in exercise, household rates in the Northeast recorded the slowest amount of appreciation in the 1st quarter of the year. The South and Southwest were being the strongest locations in the very first quarter, with the South reporting an annualized first quarter appreciation level of 21 p.c. When evaluated by selling price details, during the quarter, properties at all price details recorded constructive appreciation.

Related to national quantities, listing exercise region-by-area remains significantly beneath historic norms. Working with the identical 5-yr lookback, the index of regional listing volumes for all but a person of our areas stands 40{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} to 55{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} decrease than March 2017. A person region, the Northeast, stood just about 70{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} decrease in active listings than our baseline. Listing quantity remains tight in all regions.

METROPOLITAN Place Details AND Traits

- Metro places finish quarter on sturdy observe

- All 20 most significant Core-Dependent Statistical Places (CBSAs) accelerated in the very last thirty day period

Metropolitan parts did pretty very well in the most new quarter. All but two of the 20 greatest metro spots (New York, Philadelphia) in the U.S. recorded a lot quicker positive price appreciation in the first quarter when in contrast to the prior (Q4 2021). On a month to month basis, all 20 metros posted more quickly price tag appreciation fees in March, than in February.

Not surprisingly, Days on Marketplace (DOM) fell for mentioned properties in the U.S. and in the major metropolitan spots. Nationally, DOM remained in close proximity to all-time lows. In March, the normal Times on Industry for closed sales was 75 days. That level, although higher than the all-time small of 67 days, was really reduce than the 76-days every month averages throughout all twelve months in 2021, and was more than a 7 days shorter than any prior March on file.

ABOUT THE RADIAN HPI

Red Bell, a subsidiary of Radian Group Inc., delivers countrywide and regional indices for down load at www.radian.com/hpi, which also features details on how to obtain the comprehensive library of indices. More written content on the housing market place can be observed on the Radian Insights web site located at https://radian.com/news-and-information/insights.

The corporation presents subscription accessibility to the overall Radian HPI knowledge set and the Radian HPI Portal for content visualization and data extraction. The motor powering the Radian HPI has produced a lot more than 100,000 special info sequence, which are updated on a regular monthly basis.

The Radian HPI Portal is a self-company information and visualization system that contains a library of substantial-price indices based on each geographic dimensions as nicely as by market place, or home attributes. The platform gives regular updated entry to 9 distinct geographic dimensions, from the national amount down to zip codes. In addition, the Radian HPI presents exclusive insights into current market improvements, conditions and energy throughout numerous residence attributes, including bed room rely and livable square footage. To enable greatly enhance its customers’ comprehending of granular real estate marketplaces, the library is expanded routinely to include far more insightful indices.

In addition to the companies offered by its Purple Bell subsidiary, Radian is making certain the American desire of homeownership responsibly and sustainably as a result of items and companies that involve business-primary mortgage loan insurance policy and a detailed suite of property finance loan, chance, title, valuation, asset administration and other serious estate expert services. The enterprise is powered by technology, educated by data and driven to deliver new and greater means to transact and regulate possibility. Pay a visit to www.radian.com to see how Radian is shaping the future of home finance loan and genuine estate expert services.

/cloudfront-us-east-1.images.arcpublishing.com/dmn/O2J5Z4GLWVJNII37X5C2376ZPM.jpg)