2023 Real Estate Assessments Now Available; Average Residential Increase of 6.97{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}

WHY YOUR Evaluation May HAVE Improved

There are numerous variables that affect genuine estate assessments:

- Revenue in the community.

- Economic elements these kinds of as ordinary amount of days households have been for sale and revenue volume.

- Advancements to the house (reworking, additions).

- New construction and rezoning.

- House features, this kind of as dimensions, age, problem and facilities.

https://www.youtube.com/observe?v=B6PSwbSFptk

ASSESSMENTS ARE NOT A Monthly bill

The actual estate assessment detect is not a monthly bill. Most house owners pay out actual estate tax as component of a every month home finance loan payment. Your home loan organization then sends the taxes right to Fairfax County. However, some home owners pay back their genuine estate taxes immediately (owing July 28 and Dec. 5). Contact your home finance loan corporation if you are not sure how your taxes are paid.

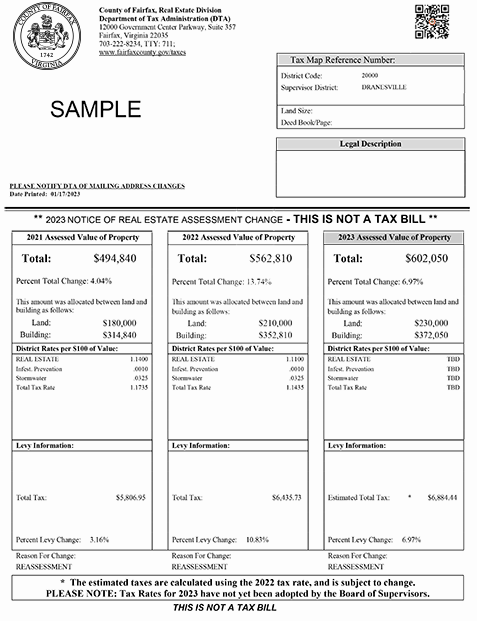

Here’s a sample assessment recognize you will obtain in the mail.

The Tax Levy is an Estimate

The believed tax levy shown on your assessment see is just that — an estimate. As needed by state legislation, the believed tax for 2023 is based on the 2023 assessment and Fairfax County’s 2022 tax costs. This is an estimate for the reason that the Board of Supervisors has not nonetheless adopted tax prices for 2023, but will do so as part of the budget method. The “levy,” or tax, is a mix of your latest assessment and the present-day adopted (2022) tax prices.

Important observe for participants in the tax relief application: The 2023 tax estimate shown on your detect does not reflect your 2023 tax reduction benefit.

Expanded Tax Relief is Available

Seniors and men and women with disabilities might qualify for true estate tax reduction, and the Board of Supervisors recently approved tax aid for the surviving spouses of armed forces associates who died in the line of duty.

For 2023, the optimum gross revenue to qualify for tax reduction is $90,000, with a maximum net value of $400,000.

The filing deadline for your tax reduction software is Could 1. You will be notified about your tax reduction position by June 30.

Desirable your assessment

If you think that your genuine estate is incorrectly assessed, you can file an attraction. Appeals need to be primarily based on both fair market benefit, absence of uniformity or errors in residence description. Merely saying that the value has improved too much in a one 12 months is not a legal basis for an attraction. Before filing an appeal, we really encourage you to get hold of Tax Administration employees:

- Schedule a phone or video clip appointment to speak to staff members at your comfort.

- Mail an inquiry by email.

- Phone 703-222-8234, TTY 711, on Mondays to Fridays from 8 a.m. to 4:30 p.m.

If you however want to file an appeal, house homeowners could start off with an administrative enchantment. Residence owners are inspired to file this attraction as early as attainable. All administrative attraction apps ought to be submitted by April 3. They should be postmarked by April 3, if mailed in, or they can be emailed, submitted on the net or dropped off at the Department of Tax Administration workplaces by 4:30 p.m. (EDT) on April 3. No exceptions. No administrative appeals will be approved just after this date. Both equally non-household and residential residence appeals may be submitted by mail or electronic mail, but only household evaluation appeals can be initiated on the net. You can download enchantment applications or phone the Tax Administration business office to attain a copy.

Authentic estate appeals can also be submitted with the Board of Equalization (BOE). The BOE conducts formal hearings and considers sworn testimony. BOE appeal types are accessible online or by contacting the BOE office at 703-324-4891, TTY 711. By regulation, all appeals to the BOE have to be submitted and postmarked by June 1 or emailed/uploaded by 4:30PM (EDT) on June 1. No exceptions.