Housing market presentation pops the ‘mythic’ Real Estate bubble

MONROE, CT — Some news tales attribute the 28-year-very low in mortgage loan programs to the “bursting housing bubble,” but Danielle Rownin, a Realtor with Keller Williams Real Estate, phone calls the bubble a fantasy.

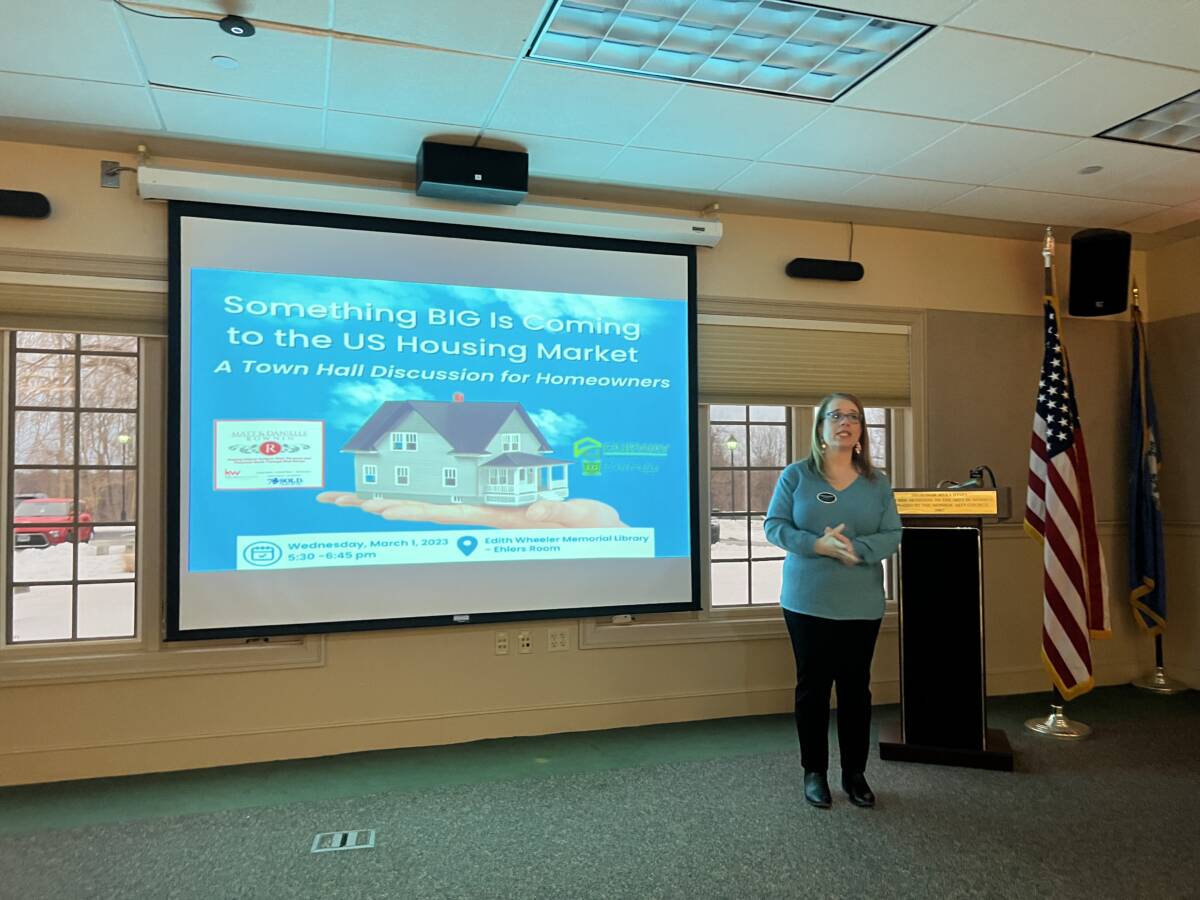

Throughout a city hall discussion on the housing market place, held in the Ehlers Place of Edith Wheeler Memorial Library very last 7 days, Rownin instructed her audience the quarantine amid the COVID-19 pandemic brought on a slowdown in design. Then the price tag of components rose, generating builders make your mind up to pull back.

Meanwhile, the growing development of functioning from property caused a mass exodus from towns to the suburbs.

“You did not have to stay in New York or other big cities for your company work, so people ended up able to relocate,” Rownin reported. “This triggered a massive housing lack. Homebuyers ended up squeezed out of the market by money prospective buyers.”

Even all those with substantial credit score scores were being no match for dollars potential buyers, Rownin explained, introducing many who could borrow ended up leasing alternatively. Soon readily available flats grew to become scarce and rental fees soared.

Shut to 79,000 renters in Fairfield County can pay for to get a house or a condo, according to Rownin.

“What I definitely experience negative for are persons who have to hire, simply because they simply cannot pay for to buy,” she mentioned. “We have a real housing shortage. There are far more butts and not sufficient seats.”

Rownin was joined by her partner, Matt, a fellow Realtor, and Rhiannon Benedetto, a licensed financial loan officer with Fairway Unbiased Home loan in Shelton, as presenters for the city corridor party on March 1. All 3 are Monroe residents.

Housing market stable

According to SmartMLS Inc., 747 solitary family houses are for sale in Fairfield County compared to 1,997 at this time final year, a fall of 62.5 {73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}. Pending gross sales are down 31.6 per cent and closed gross sales 52 p.c.

On the other hand, the median revenue rate nevertheless rose from $450,000 to $535,000 or by 19 p.c.

In February, Monroe experienced 12 active residences for sale, down 66 per cent from previous yr (35). Pending gross sales were being the exact same at 11 with 4 revenue shut that thirty day period, a drop of 60 {73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} from the 10 closings in February of 2022.

House values also improved in Monroe through the time period, from a median profits cost of $459,500 to $537,500, a 17-percent jump.

Rownin mentioned mounting dwelling values is proof that the housing industry is steady and transferring ahead.

Adam Gitow, who attended the presentation, questioned if worry is preserving some house owners from moving.

Rownin explained some of it is anxiety driven, with householders afraid to offer their property without having becoming ready to discover a new put to transfer into, or downsizing and obtaining to spend additional for a new dwelling with less income remaining over for retirement.

She reported sellers can make the sale of their home contingent upon their discovering a new home with a “subject to” clause. Matt Rownin mentioned some buyers, who are emotionally connected to a property, are willing to hold out if they have to.

Senior housing choices

Leslie Gosselin, vice chair of the Commission for the Ageing in city, was among the 12 individuals in attendance Wednesday evening.

“We have Higher Meadows, which most see as a moderately priced senior growth,” she mentioned. “Say seniors want to downsize and sell their residence for $485,000. The new 55-and-older community staying built on Purdy Hill Street has a starting off price of $559,000.”

She said quite a few seniors are not able to pay for to acquire out a new home finance loan and shell out popular costs for a additional pricey property.

“The challenge for most seniors is, they really don’t want to shift out of town,” Gosselin explained. “Their church is here and their buddies are below.”

Danielle Rownin reported they are scheduling a different presentation with all of the housing possibilities for seniors, as well as how to make their go safer and more comfy.

“And much more inexpensive,” Gosselin included.

Climbing fascination costs

Due to the fact the previous economic downturn, The Federal Reserve had kept interest fees at historic lows to persuade buying, when obtaining billions of dollars in bonds each individual month to promote the economic system, in accordance to Benedetto. But now The Fed has been boosting fees to command climbing inflation.

On March 17, 2022, the federal cash fee was .25 to .50 {73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}. From Jan. 31 to Feb. 1, it had risen from 4.50 to 4.75 per cent.

The presenters reported the traditionally very low interest costs are not most likely to come back, so if there is a property you want, you ought to get it now and, if prices appear down, see if you can refinance.

In spite of higher fascination fees, property values are continue to soaring. Benedetto reported individuals who are not relocating now could determine to make the equity of their house operate for them.

Amongst the readily available choices are buying an financial investment home, creating property improvements, spending off debts, or cashing out to fork out for college or university tuition or a new car with a dwelling equity line of credit history, she explained.

72Sold®

After the presentation on the latest housing market Matt and Danielle Rownin talked about 72Sold®, a countrywide firm and America’s main household providing program, in accordance to Matt Rownin.

“It gets all consumers, puts them in a competition and sells your residence inside of 72 hrs,” he stated. “It puts you in the driver’s seat.”

Danielle Rownin said the extended a residence sits on the current market, the least likely it is to sell for industry worth as potential buyers feeling desperation and occur in with lower and lessen provides.

Amongst the techniques of 72Sold®, is to show less and superior photos on the internet. “We want the consumer to simply call us to learn far more about the home,” Rownin explained, introducing if ads incorporate way too several aspects, there is no want to simply call.

Customers have to connect with for particular person appointments for showings, so those people times can be booked reliable and, with the revolving doorway, Rownin said homebuyers will see other people coming to see the dwelling as they go (and vice versa), developing need.

The sellers enable their agent to be present at the open house, enabling the Realtor to have discussions with possible consumers, although gauging their reactions to the house or apartment.

Agents for potential buyers usually notify the agent for the seller that their shopper both desires to make an offer or is not intrigued without having beneficial element of the why, according to Rownin. But by becoming existing at a displaying, Rownin said she can study buyers’ body language.

She could attain out to a possible customer afterward and say, “we’re not anticipating provides until eventually Sunday, but you look to truly like this property. Do you want to make an offer you?” If an provide is made, she reported it won’t be a minimal 1.

Whilst any Realtor can try out these strategies, the 72Sold® household advertising software is only utilized by Keller Williams agents, who acquire the schooling.

All respectful reviews with the commenter’s 1st and final title are welcome.