Market Shifts, Rate Hikes And Why Real Estate Stocks Can’t Get A Break

A year back, anything bizarre started out occurring.

The housing current market was on hearth, with house selling prices soaring and listings flying off the marketplace in days, or occasionally several hours. Fascination charges have been at history lows and would linger or even fall even more in the coming months. There was some uncertainty thanks to the coronavirus pandemic, but all in all it was for several persons an outstanding time to be in true estate.

And yet, in spite of all of that, share selling prices of publicly traded genuine estate providers were falling.

Now, a calendar year later, it turns out those people slipping rates weren’t a fluke. In actuality, quite a few of the largest names in real estate have witnessed their share selling prices steadily tumble for months and months on conclusion at this point — collectively costing them billions in valuation.

So what is likely on? Why is it that buyers are neat on true estate businesses on the heels of what proved to be just one of the greatest years on the books?

The response has to do with increasing rates, a struggling inventory industry and tepid monetary outlooks, amongst other things. And whilst the foreseeable future is uncertain, the story of dropping share rates might not be above still.

Massive drops

To start with things initial, it is well worth noting that a lot of actual estate companies’ share costs have experienced a great several days recently.

As of late Friday afternoon, for illustration, Realogy’s share cost was up about a dollar-and-a-half when compared to five days earlier. Compass was also up about that interval, in its circumstance by about $.50, though Zillow rose extra than $1.33 above the training course of previous week. Other businesses, these kinds of as Opendoor, Offerpad, Redfin, eXp Environment Holdings and RE/MAX all also observed their share selling prices rise around the course of the past five sector days.

And all those gains are nothing at all to sneeze at.

Several companies noticed these price tag bumps at the close of the 7 days, when a new report indicated inflation was slowing. The report aided boost the industry in general, and the point that true estate corporations benefited from the information highlights how their share prices are sensitive to total stock current market dynamics.

Even so, above the very last calendar year-and-a-fifty percent, most significant serious estate companies’ share charges are way down. In excess of the past 12 months, for example, Compass has fallen about 37 p.c, Realogy about 25 {73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}, Zillow extra than 65 percent, and Opendoor more than 52 per cent.

Some of the share price drops are fairly stark when set in dollar quantities.

Zillow, for example, was trading shares for more than $200 last February and $100 in the drop. But as of Friday, the company’s shares ended up only fetching about $41.

Opendoor shares had been trading for much less than $8 Friday, down from a large of just about $35 in February 2021, and $24 in the drop of previous calendar year.

Redfin shares were being investing Friday in the mid $10 variety, also a large tumble from more than $50 a share in the tumble and just about $100 in February 2021.

EXp was trading Friday in the mid $14 variety, also down from all around $50 in the slide and from an all-time substantial of just about $80 in February.

The record could go on, but you get the issue. Most key authentic estate companies’ share selling prices right now are a faint shadow of what they were being just final yr. As it turns out, Inman’s report final year on faltering actual estate firm stocks was just the starting of a prolonged-running tale.

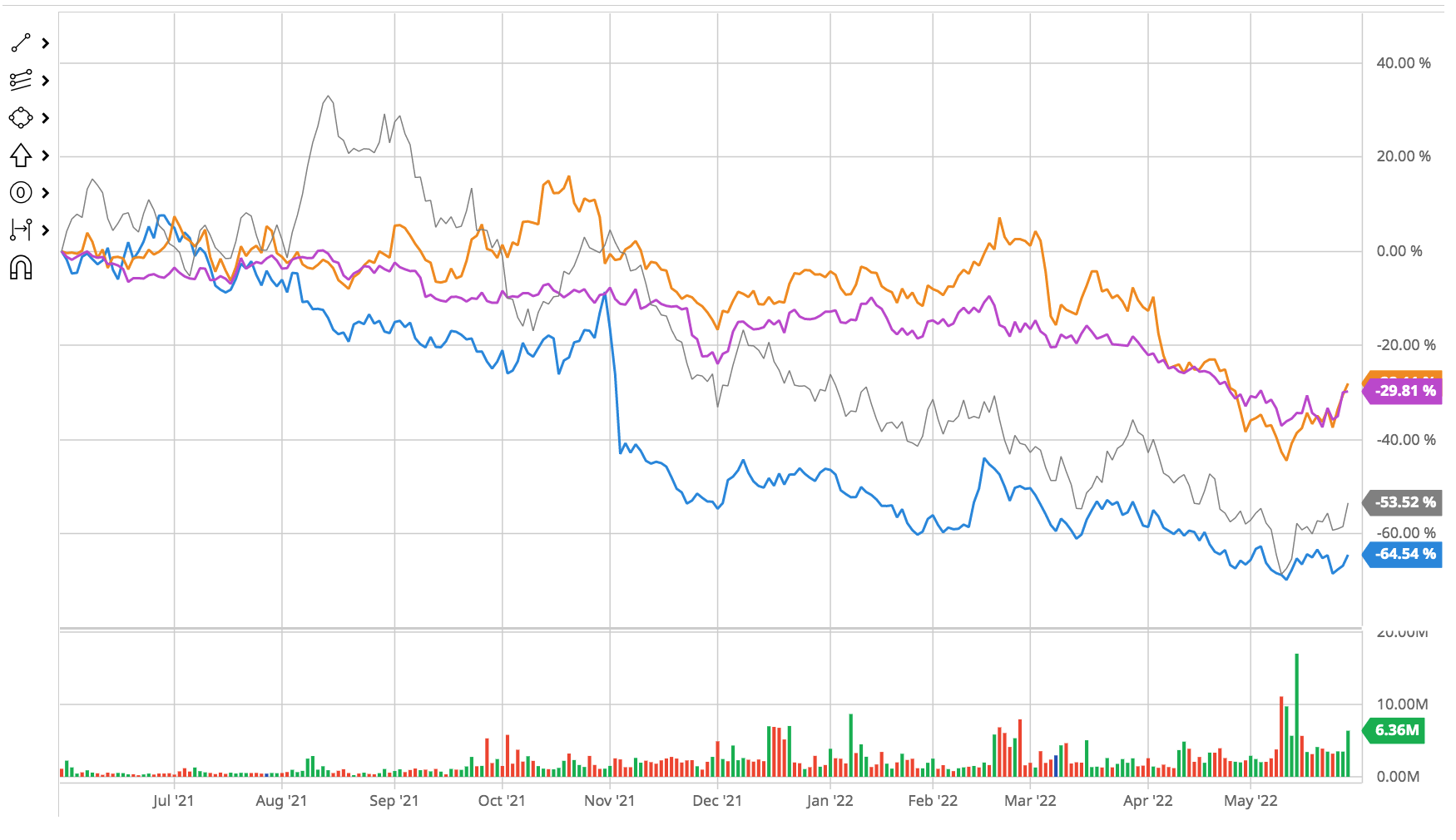

This graph exhibits the last 12 months of share charges for Compass (gray), Zillow (blue), Realogy (orange) and RE/MAX (magenta). Credit: barchart

The over-all inventory marketplace has been having a beating currently also, and that trend unquestionably accounts for some of what is heading on.

On the other hand, about the past 12 months the Nasdaq Composite was only down 11.77 percent on Friday, when compared to 1 12 months previously. The S&P 500 was only down about 1 p.c.

Credit score: Google

What this signifies is that even though shares usually struggled of late, over the last 12 months true estate corporations, in unique, have substantially underperformed the current market.

So why is this occurring?

Some of it is in all probability attributable to particular, and reasonably isolated, incidents. Previous slide, for illustration, Zillow declared it was shuttering its iBuying enterprise Zillow Delivers. The news promptly despatched Zillow’s share value plummeting and it hasn’t recovered given that.

That shock did not just impression Zillow, nevertheless. Adhering to the information of Zillow’s stumble, the two Opendoor and Redfin — rivals of several parts of Zillow’s business enterprise — also equally noticed their share selling prices dip, seemingly a indication of investors’ wariness about the property engineering sector.

The lesson, then, is that complications in 1 company can hurt rivals in the minds of traders.

Earnings outlooks

A further element that may perhaps be at perform in this article is real estate companies’ own fiscal outlooks.

It’s constantly curious when companies report sturdy earnings benefits, and then see their share costs immediately drop. And yet, that has took place again and yet again to serious estate providers above the past calendar year — which include during the most current earnings season previously this month.

Even so, what was significant about this last earnings season was that though many providers posted solid quantities and defeat analysts’ forecasts, they also nearly universally adopted a cautionary tone. “Headwinds,” for illustration, was the buzzword in various earnings calls with traders. And the common consensus among the leaders of main companies — Zillow, Redfin, eXp, Compass, and other people — was that the coming months are very likely to be slower than the previous two a long time.

Buyers may have been having to pay attention to individuals cautious earnings studies. Or they may possibly have just been seeing the very same headwinds the studies stated. Possibly way, nevertheless, the truth that serious estate corporations by themselves have been sounding the alarms about a slowdown — which centered on the hottest facts seems to be happening right now — most likely allows explain at the very least in part, why the sector has underperformed in contrast to the broader industry.

Mortgage rates are vital

One of the most important factors real estate is slowing down rather right now —though normally it stays a seller’s current market and professionals don’t foresee a bubble — is that house loan fees are climbing. In truth, this change away from the historically small premiums of the past two years has been arguably the most significant real estate tale of 2022 so far. The fee will increase are generating it much more highly-priced to borrow funds, and slicing into homebuyers’ means to afford homes.

Curiosity prices — which are established by the Fed and affect, but are not the identical as, home finance loan premiums — have also been increasing, and that has weighed on the stock market normally. But genuine estate will get a kind of double whammy in these sorts of cases curiosity rate hikes influence the broader market, and then authentic estate businesses endure once again due to the fact their conclude end users have to contend specifically with house loan charges as perfectly.

Real estate’s “Wile E. Coyote moment”

Adam Gower — who as a result of his GowerCrowd firm specializes in crowd funding, expense and digital actual estate platforms — explained this as authentic estate’s “Wile E. Coyote” minute.

Adam Gower

“Remember how he operates at exceptionally superior speed and retains heading even when he’s remaining the edge of the cliff,” Gower reported. “That’s exactly where I assume the housing sector is proper now.”

Gower pointed to slipping profits volume, stating that normally in a downturn “volumes will fall off but rates will continue on to rise.”

“It’s like that emotion you have when you are right about to tip off your chair,” he included. “Thats the second we’re in now.”

Gower does not focus in the inventory sector, but he does function with investors who get large qualities, this kind of as apartment structures, between other points. And he reported recently it has turn into a lot more challenging and additional high-priced to come across qualified prospects and to convert them into closed promotions. His stage: The types of investors he performs with are “pulling back from the sector.”

Gower speculated that the identical matter could be occurring in the stock marketplace as all of the earlier mentioned variables weigh on traders’ minds.

The takeaway, then, is not just that actual estate stocks experienced a tough go above the previous yr. Rather, it’s that the tough go is nonetheless heading, and will possible continue on. Many thanks to mounting prices, lukewarm outlooks, and a broader market place that has been sputtering currently, actual estate enterprise stocks may perhaps not finally capture a break any time before long.

“For shares all these developments that I’m looking at on the personal equity aspect you are viewing on the community aspect,” Gower explained. “These factors talk to a typical malaise in the actual estate industry.”

E mail Jim Dalrymple II