Real Estate Markets Are Addicted To Easy Money

ArLawKa AungTun

By Ryan McMaken

On Friday, residential actual estate brokerage agency Redfin unveiled new knowledge on property price ranges, displaying that costs fell .6 percent in February, calendar year more than year. According to Redfin’s numbers, this was the initially time that dwelling price ranges truly fell given that 2012. The yr-about-yr fall was pulled down by specially big declines in 5 markets: Austin (-11{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), San Jose, California (-10.9{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), Oakland (-10.4{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), Sacramento (-7.7{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}), and Phoenix (-7.3{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}). In accordance to Redfin, the standard every month mortgage payment is now at a history large of $2,520.

The Redfin quantities arrive a few days new quantities from the Scenario-Shiller household selling price index displaying further more slowing in residence prices expansion because late previous yr. The market’s expectation for December’s 20-metropolis index experienced been -.5 per cent, month more than month, and 5.8 p.c, 12 months in excess of year. But the figures came in worse (from the seller’s standpoint) than was hoped. For December – the most latest monthly info accessible – the index ended up demonstrating a thirty day period-in excess of-month drop of -1.5 percent (seasonally modified), and a year-in excess of-yr get of 4.6 p.c (not seasonally adjusted).

By most accounts, the rapidly-slowing sector faces headwinds thanks to growing curiosity premiums, like the standard 30-12 months mounted mortgage, which is now back up about 6 p.c. This places homeownership out of arrive at for many initially-time consumers and is also a big disincentive for latest owners to “go-up” into bigger-priced houses given that any new home would appear with a substantially increased mortgage fee than was readily available a 12 months in the past.

Not remarkably, desire for new mortgages has plummeted. CNBC noted past 7 days:

Home loan purposes to invest in a house dropped 6{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} very last 7 days in contrast with the previous 7 days, in accordance to the Home finance loan Bankers Association’s seasonally modified index. Volume was 44{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} decrease than the similar week a person year ago, and is now sitting down at a 28-yr reduced.

So, sales have fallen and, at the very least in accordance to Redfin, selling prices are falling way too. This is what we must assume to see in any natural environment where the real estate marketplace is not currently being incessantly fueled by easy income from the central financial institution. Just after all, easy cash for genuine estate marketplaces experienced been the principal story given that 2009. In recent months, nonetheless, the Fed has allowed fascination prices to rise although pausing attempts to include more mortgage-backed securities (MBS) to the Fed’s portfolio. Without individuals important supports from policymakers, the real estate current market simply just lacks the market place need that is essential to maintain immediate growth. Opposite to what countless mortgage loan brokers and actual estate brokers explain to them selves and every single other, there is important minor capitalism in true estate markets. It is a market place that is extensively addicted to, and dependent on, continued stimulus and subsidization from the central lender.

Devoid of the central financial institution propping up MBS need in the secondary current market, main-industry property finance loan loan providers have much less pounds to throw about. That usually means increased curiosity premiums and much less eligible purchasers. Equally, by placing a increased goal price for the federal cash level that banks should pay out to take care of liquidity, marketplaces facial area fewer monetary progress in general. That comes with a lessening general desire that – in the shorter expression, at the very least – drives up incomes for both current and possible homebuyers.

Even worse, the ongoing nominal cash flow expansion that does exist is not maintaining up with value inflation. The result has been 22 months in a row of detrimental true wage growth, and that will translate to slipping need.

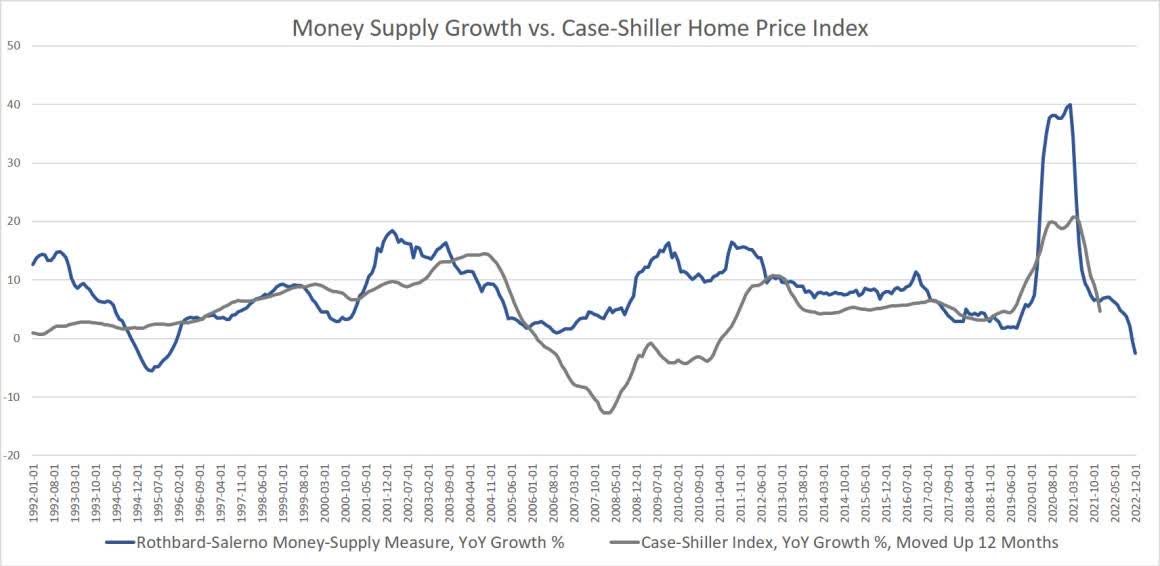

This near link in between effortless money and demand for households can be witnessed when we evaluate progress in the Case-Shiller index to progress in the income supply. This has been especially the scenario due to the fact 2009. As the graph reveals, at the time dollars-provide development starts to sluggish, a related change happens in dwelling rates one year later on.

As income-provide progress swiftly slowed just after January 2021, we then noticed a very similar development in dwelling prices 12 months afterwards, with a swift deceleration in the Scenario-Shiller index. Remarkably, in November of final yr, revenue-offer growth turned negative for the initial time due to the fact 1994. That factors toward continued drops in home charges all through this calendar year. If Redfin’s February figures are any indicator, we should really expect rate expansion to switch damaging in the Scenario-Shiller quantities this spring.

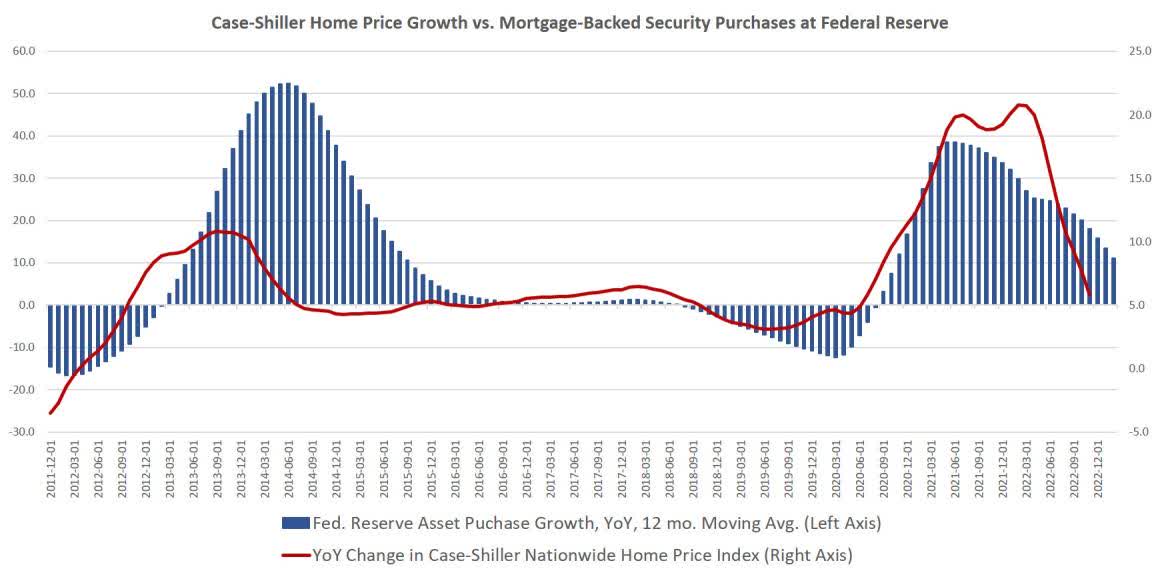

Now just picture how significantly more lackluster serious estate marketplaces would be without having the Fed obtaining up all individuals trillions in MBS above the previous decade. It’s now been additional than a ten years considering the fact that we experienced any idea what real estate selling prices actually would be without having monumental amounts of stimulus from the Fed. The cash-printing-for-mortgages scheme entered its very first period throughout 2009 and 2010 and then was just about non-prevent from 2013 to 2022, topping out close to $1.7 trillion in 2018. The Fed experienced started to pull back on its MBS property in 2018 and 2019, but of study course, reversed course in 2020 and engaged in a frenzy of new MBS buying. In that time period the Fed ordered an extra $1.4 trillion in MBS. That ultimately ended (for now) in the tumble of 2022. The Fed continue to holds above $2.6 trillion in MBS assets.

If we glance at yr-above-12 months changes in these MBS buys along with Case-Shiller property prices, we once again see a clear correlation:

It can be apparent that after marketplaces feel the Fed might yet again improve its MBS buys, home price ranges once again surge. This near romantic relationship should not surprise us considering the fact that the quantity of MBS buys is a sizable part of the in general industry. Since 2020, the Fed’s MBS stockpile has equaled at least 20 per cent of all the domestic house loan credit card debt in the United States. In early 2022, Fed-held MBS belongings peaked at 24 percent of all US house loan personal debt, but they however manufactured up above 20 p.c of the market as of late 2022.

Lest we believe that serious estate markets seem to be weathering the storm reasonably properly, let’s retain in brain this is all taking place throughout a period when the unemployment fee is extremely reduced. Certainly, the federal federal government has significantly exaggerated the quantity of position growth that has occurred in the economy over the earlier 18 months. Having said that, it can be also rather apparent that actual estate marketplaces are not yet observing significant numbers of unemployed employees who can’t shell out their mortgages. When that does come about, we can assume an acceleration in falling home selling prices. For now, most mortgages are being compensated, and even as actual wages tumble, most home owners are cutting in places other than their property finance loan payments. When career losses do established in, all bets are off, and a wave of foreclosures will be very likely. Numerous jobless workers is not going to be able to provide promptly to keep away from foreclosure either. With so several debtors who can manage mounting home loan charges, there will be comparatively several customers. That’s when price ranges will genuinely get started to arrive down—when there is a combination of inspired sellers and increasing desire fees.

For now, though, the investor class remains reasonably optimistic. Marcus Millichap CEO Hessam Nadji was on Fox Organization very last week flogging the now properly-worn narrative that we must anticipate a “smaller economic downturn,” but Nadji did not even entertain the strategy that there may well be sizable layoffs. Alternatively, he advised that there is now a mere temporary softening of desire, and that will reverse itself at the time the Fed reverses course and embraces quick income once again. In other words, the Fed will time anything beautifully, and it will be a “comfortable landing.”

This effectively captures the mindset of the “capitalists” heading the true estate marketplace proper now. It’s all about the Fed. Without having the Fed’s straightforward dollars, demand from customers is down. After the Fed pivots back to forcing down curiosity rates and acquiring up more MBS, very well then delighted situations are below once more. Gone is any discussion of employee efficiency, savings, or other fundamentals that would push demand in a real capitalist sector. All that issues now is a return to effortless dollars. The actual estate sector will get significantly desperate for it. In 2023, it truly is come to be the pretty foundation of their “sector.”

Disclosure: no positions

Editor’s Note: The summary bullets for this short article ended up selected by Searching for Alpha editors.