Reassessment report projects 26{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} average increase in taxable real estate values | News

Taxable real estate benefit in Fauquier County is projected to raise by approximately 26{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} subsequent 12 months, in accordance to Fauquier County Income Commissioner Eric Maybach. The reassessment of authentic estate values has been having position over the earlier 12 months. Under the county’s ordinance, reassessments take location every single four many years.

House owners of serious estate could stop by r-reo.fauquier.gov to see the preliminary taxable price of their home. Homeowners may dispute the reassessment values via Dec. 17, and a letter will be mailed to all authentic estate holders on Monday with more facts. The complete timeline of the 2022 reassessment course of action can be uncovered in this article.

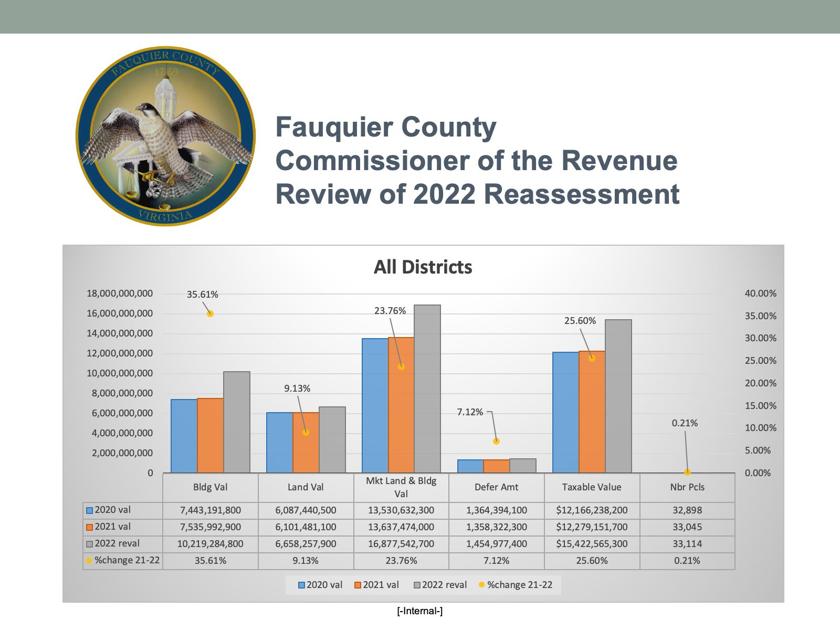

Taxable value is projected to maximize to $15.4 billion from $12.8 billion, an boost of 25.6{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}, Maybach instructed county supervisors at a function session Thursday. Tax aid programs for aged and disabled residence house owners will most most likely cut down the powerful taxable benefit by about a few percentage points, he defined. The present in general real estate tax amount is 99.4 cents for every $100 of worth.

Real estate taxes are by much the largest source of regional earnings for the county, accounting for $102 million of the $160 million community revenue in the recent finances. The county’s funds totals $341 million this 12 months — a lot more than 50 percent is funded by state and federal pounds — such as $165 million committed to the college division.

County officials emphasized that an maximize in genuine estate values won’t essentially suggest an equivalent increase in precise true estate tax compensated. Tax costs for 2022 will be established by supervisors through upcoming March’s spending budget adoption procedure — which incorporates general public hearings — and supervisors could pick out to lessen the tax level to offset some or all of the maximize in taxable price.

“For most persons, this is a revaluation from the valuation in 2018, which was assessed in 2017,” stated Deputy County Administer Erin Kozanecki. “Something for citizens to preserve in mind: … tax premiums will not be determined till March 2022.”

When 2018 reassessment values took impact, for instance, taxable benefit elevated by 12.7{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}, according to Maybach. But county supervisors decreased the tax rate the subsequent 12 months from $1.039 to 98.2 cents, meaning the effective tax price greater by about 7{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} — not by nearly 13{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82}.

At least some improve to the powerful tax charge is most likely, however. The projected increase in true estate values — and for that reason revenues — was cited as lately as Thursday’s supervisors assembly as a variable in funding raises for county staff outside the house the university division, for occasion.

With Thursday’s unanimous vote to fund a 2{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} shell out increase for people staff on top of a 3{73375d9cc0eb62eadf703eace8c5332f876cb0fdecf5a1aaee3be06b81bdcf82} elevate handed previously this yr, the county has fully commited an additional $2.6 million per year to pay for people raises. Previously this year, supervisors also fully commited $2.7 million per year to the school division to aid fund pay back raises for faculty workers.

Key funds assignments integrated in the county’s 5-year prepare may perhaps also spur the will need for income outside of what is presently gathered. A $55 million courthouse consolidation challenge is the premier capital expenditure bundled in the existing finances other main money initiatives incorporate the renovation and growth of Taylor Center Faculty and improvements to the Central Sports activities Complicated.

This year’s preliminary reassessment report found that the true marketplace price of all land and structures in Fauquier County is $16.9 billion, with about $1.5 billion of that benefit deferred for tax purposes below the county’s conservation tax-credit history applications that incentivize keeping large tracts of land undeveloped.